Real Insights feature curated content from industry leaders during the program formation of the Real Estate Forums and Conferences. Each report features on the Top 10 Real Insights focused on major trends. For more details on the content of the Winnipeg real estate market, click the following Insights.

The Province’s diverse economy has been a hedge against times of economic downturn.

Studies by Moody’s Investors Services of New York have shown that Winnipeg has one of Canada’s most diverse urban economies.

The diverse manufacturing base – which includes aerospace materials, buses, building products, machinery, furniture, electronics, pharmaceuticals, plastics, and processed foods – gives the province a degree of resilience during economic downturns.

Prior to the COVID-19 pandemic, this diversity has led to an unemployment rate that is consistently among the lowest in Canada.

The provincial economy added approximately 6,500 jobs or about 1% job growth from December, resulting in the province’s largest month-over-month increase since April 2008. Job growth continued in February when an additional 3,200 Manitobans were working, about 0.5% job growth. According to Statistics Canada, Manitoba’s February unemployment rate was 5.0%, down 30 bps from December and remains the second-lowest unemployment rate among Canadian provinces.

Manitoba produces about 10% of the nation’s agricultural products. Based on strong fundamentals in the supply of raw agricultural products, skilled workers and a competitive cost environment, food processing is the largest manufacturing sub-industry in Manitoba, accounting for 26% of manufacturing sales in 2018. Food processing continues to grow, with major new investments in dairy, meat, potato and pea processing facilities across Manitoba.

The world’s largest pea processing plant, valued at $450 M, is under construction with operations scheduled to start by the end of 2020, which may or may not be delayed at this point.

A second $65 M pea plant and a $94 M oat processing plant are also in the works.

International studies of business costs conducted by KPMG have consistently shown the competitiveness of business costs in Manitoba. According to the most recent edition of KPMG’s Competitive Alternatives study, Winnipeg ranks as the lowest-cost city in which to conduct business in the North American Midwest.

The provincial Innovation Growth Program was launched in June 2019 as a key element of Manitoba’s Economic Growth Action Plan. The Manitoba government has selected five leading-edge businesses to receive more than $350,000 through this new program:

• Evolution Wheel

• Aquatic Life

• TRAINFO Corporation

• Creative Applications for Sustainable Technologies Inc.

• SolarSkyrise

These projects will also lend support to the Manitoba Works Plan which was to create 40,000 new jobs across the province over the next four years, while also supporting the Made-in-Manitoba Climate and Green Plan by assisting companies that are developing technologies in clean tech areas, the province stated.

An upgrade to Winnipeg’s sewage treatment system was slated to start in 2020 for a 2025 completion. The estimated cost of $1.8 B will make it the most expensive capital-construction job in the City’s history.

Construction has begun on the newly approved $453 M Manitoba-Minnesota Transmission Project. The line will expand electricity exports by linking generating stations in northern Manitoba with the newly completed Bipole III transmission line across the US border.

Winnipeg’s International Airport received $30.4 M in federal government funding to build a new cargo logistics facility.

The construction of a 140,000 sq. ft. cargo logistics facility will benefit producers in multiple industries, particularly e-commerce, agricultural livestock, pharmaceutical, nutraceutical, and aerospace.

Winnipeg Richardson International Airport has a $3.4 B economic impact and supports over 17,000 jobs. It is also the number one airport in Canada for dedicated freighter flights.

Greater Winnipeg has the largest office inventory among Canada’s medium-sized cities, with almost 12.4 M sq. ft.

According to Altus Group, the office Inventory of Greater Winnipeg has reached nearly 12.4 M sq. ft. as of Q1 2020. Downtown Class A vacancy rate in Winnipeg dropped to 6.9% in Q4 2019 from 8.6% in the previous quarter, then bounced back to 7.4% in Q1 2020. 2019 saw one downtown office completion in Q3, which was the True North Square at 223 & 225 Carlton Street, adding 37,200 sq. ft. to the Class A market. There were no completions in the first quarter of 2020, Altus Group reports.

Positive absorption in the SHED, as well as the towers at Portage and Main, had underscored the demand for Class A office space in Winnipeg.

The Downtown Class B vacancy rate has been sitting at a sub 7% level throughout 2019 and jumped to 7.7% in the first quarter of 2020, compared to 6.3% in Q4 2019, while the Downtown Class C vacancy rate reached a 5-year low at 6.7% in Q1 2020, Altus Group reports.

The growth in Class A inventory from the first quarter of 2018 to the end of 2019 had a positive effect on the Class B and Class C markets. Landlords had increased investment in older properties as they jockeyed for position to secure tenants in a “move up” market. To deal with the ballooning Class B and Class C vacancy, some office buildings were looking to convert to residential use.

Class C vacancy may increase with the impacts of COVID19, also considering that SkipTheDishes will migrate from its offices from the Exchange District to the SHED this year.

In Q4 2019, SkipTheDishes leased over 95,000 sq. ft. at 242 Hargrave Street.

Amazon’s Web Service acquired ThinkBox Software, a Winnipeg-based company founded in 2010. Their new 13,000 sq. ft.premises will be in the Johnston Terminal owned by Artis REIT located at The Forks.

As of Q3 2019, the tech industry accounted for 17.1% of major office leasing activity since the start of 2018, according to CBRE numbers.

Winnipeg’s suburban market had a vacancy rate of 7.1% in Q1 2020, dropping slightly from 7.4% in the previous quarter. The suburban market had one completion in Q3 2019 with 57,000 sq. ft. Class A space, and no completions in 2020 so far, according to Altus Group.

CBRE’s Ryan Behie said the suburban office market had been particularly hot in Winnipeg’s southwest quadrant, where commercial space gets snapped up quickly amidst strong population growth and new development.

“There are some office parks in southwest Winnipeg that typically run a vacancy rate of one or two per cent,” he said at the time .

The most critical element of the Winnipeg office market now will be to see how COVID-19 has impacted the tenants, leasing, landlords, and net asset values of these properties.

Construction activity outside city limits was driving the Winnipeg industrial market.

Industrial vacancy increased to 4.5% in Q4 2019 as 284,000 sq. ft. of new industrial products came to market. This was the third consecutive quarterly increase in vacancy. According to JLL, this is a more balanced market compared to the sub 4% vacancy in 2018.

“We’ve had a growing, vibrant industrial market constrained only by a lack of new supply, new construction,” said Ryan Behie, CBRE Vice-President in Winnipeg.

Construction activity outside city limits has driven the Winnipeg industrial market.

At the end of 2019, construction activity in the surrounding Rural Municipalities (RM’s) of the city continues to be the story of the Winnipeg industrial market. Of the 559,000 sq. ft. of space currently under construction, 62% of this inventory is located in either the RM of Rosser or the RM of MacDonald.

188,000 sq. ft. of new industrial space was brought to the market in Brookside Industrial Park in Q4 2019 with a further 177,000 sq. ft. still under construction.

Within St. Boniface Industrial Park to the southeast, construction has begun on Plessis Business Park. Upon completion, this development will be comprised of five multi-tenant buildings ranging from 31,000 sq. ft. to 98,600 sq. ft.

Shindico is also branching out into industrial space and plans to build an approximately 40,000 sq. ft. building on spec in the Plessis Business Park in north Winnipeg on more than 22 acres of zoned land it acquired recently.

Two commercial condo projects are now under construction. In South Landing Business Park, Storehouse will be bringing approximately 25 units to the market while at 11 Vervian Drive in Brookport Business Park, another 13 units were expected to be brought to the market this year.

Quadreal and Canada West Limited are expected to deliver new leasable inventory this year at Northwest Business Park and Brookside Industrial Park. Combined, these new developments could add 200,000 sq. ft. of new construction over the next 12 months.

Colliers reports that there has been an unprecedented level of growth and development in CentrePort. There was over $117 M in building permits issued in 2019 – ten times the total of 2018 levels.

Construction is also underway on a new 250,000 sq. ft. FedEx Ground package sorting facility.

Accelerating e-commerce has been a driving factor for the demand for industrial space. Consumers also want faster delivery times, which means retailers have to improve logistics and find warehouse space close to major centres in order to remain competitive.

Increased demand for warehousing and distribution operations from online retailers and logistics companies keeps industrial an attractive asset class amid economic challenges, according to Altus Group’s Investment Trends Q1 2020.

Online shoppers were willing to wait 4.1 days for paid shipping deliveries in 2018, down from 5.4 days two years earlier, according to an e-commerce study by Canada Post.

Paul Morassutti, Vice-Chairman of CBRE said the shift to e-commerce in retail has been a great tailwind to the industrial sector, with rents and values going through the roof.

The retail sector is undergoing a revitalization that emphasizes customer experience.

Let’s consider the pre-COVID-19 situation in this asset class.

In July 2019, Starlight Investments acquired Portage Place shopping mall in downtown Winnipeg for $47 M. Starlight Investments plans to spend up to $400 M to overhaul theshopping mall.

Starlight’s vision includes two residential towers with student and family housing options, an elevated skywalk, renewed commercial space, a child-care centre and a grocery store.

Construction on the mixed-use development is expected to begin in 2021.

Hargrave St. Market at True North Square in downtown Winnipeg opened last December. The 30,000 sq. ft. food hall is located on the second floor of 242 Hargrave and features a diverse line up that offers pizza, craft beer, coffee, ramen, tacos and a lot more.

As well, a new 5,000 sq. ft. grocery store will open within the market in 2020. The Italian urban grocery concept is curated and operated by Chef Bobby Mottola.

The North West Company (NWC) is selling 34 of its 46 Giant Tiger stores in Western Canada back to parent company Giant Tiger Stores Ltd. The total sale price amounts to $67.5 M.

NWC will retain six Giant Tiger stores in “northern gateway locations”: La Ronge, and Meadow Lake, Saskatchewan, The Pas and Thompson, Manitoba, and Sioux Lookout, Ontario, and will convert its Prince Albert location to a Valu-Lots clearance centre.

It will close six stores in Red Deer, Fort Saskatchewan and Wetaskiwin, Alberta; North Battleford and Weyburn, Saskatchewan and the Stafford Street location in Winnipeg.

The e-commerce sales growth accelerated to 22.4% in 2019, with online sales from store and non-store retailers reaching a combined $22.1 B, according to Statistics Canada. In February 2020, the e-commerce sales increased 17.8% year-over-year to $1.6 B due to social distancing.

Despite the growth of online shopping, customers continued to visit physical stores prior to the social distancing measures.

In its third edition of the Connected Shoppers Report, Salesforce Research surveyed over 10,000 consumers worldwide. The survey showed that Canada stores were critical for discovery, experience and fulfillment. The number one reason consumers shopped in-store was to get merchandise immediately, followed by the ability to touch and feel merchandise, while 52% of shoppers have purchased a product online and picked it up in-store.

“We’re seeing consumers really valuing the stores not in isolation but as part of the overall omni-channel shopping process. While products are important, experience really has elevated as one of the most important reasons why a consumer shops with a particular brand and as part of that experience sustainability and trust has become very important particularly with the younger generations”, said Rob Garf, Vice President of Strategy and Insights for retail and consumer goods at Salesforce.

Retailers are going to the next level creating experiences for their customers. Cadillac Fairview is launching a shopping app, CF Browse, that allows shoppers to interact with the company’s retail centres through their mobile devices.

Oxford Properties had success with its entertainment attraction, “The Dr. Seuss Experience” its Square One shopping centre in the GTA.

Canada Goose created a multi-sensory experience they have called “The Journey” at its store at CF Sherway Gardens Mall. Consumers entered a “cold room” where Arctic conditions were simulated, and it snowed daily.

When consumers entered the room, it was dark and cold, -12 degrees Celsius. The walls were projection screens with original films about the cold and nature, narrated by Lance Mackey, an Iditarod champion, and Sarain Fox, an artist and indigenous activist from the Anishinaabe nation.

The new, experience-focused Canada Goose method was part of a trend toward what Jean-Pierre Lacroix, President of the retail design firm Shikatani Lacroix, called “hub and spoke strategy.” In that analogy, writes Jake Edmiston in the Financial Post, a brand has a core store that is focused heavily on the kind of experiences people like to photograph and post about.

That hub created social buzz, which pushed sales to the spokes —the e-commerce and traditional physical stores.

“This is the future of retail,” Lacroix said. “When’s the last time you went to a store and it was so exciting and so memorable you told 20 friends?”

The next step now thought will be to examine the initial impact of COVID-19 on retailers, landlords and consumer buying trends. How will it alter in the short or long term?

Apartment vacancy in Winnipeg holds steady while rents continue to grow despite increase in stock.

Apartment vacancy in the Winnipeg Census Metropolitan Area (CMA) was up slightly to 3.1% in October 2019, compared to 2.9% in October 2018.

The average rent climbed by 3.5% to $1,070. However, the rate at which rent was increased slowed from 4.0% in October 2018.

Increased construction resulted in more apartment completions in 2019, leading to an increase in the rental supply in the Winnipeg CMA. According to CMHC’s October 2019 Rental Market Survey, apartment rentals expanded by a net 890 units from the 2018 survey, with two-bedroom units contributing 440 of the additions.

The supply of rental condominium apartments increased by 2% from 3,813 in 2018 to 3,880 in 2019.

The one area Sandy Shindleman, President of Shindico, expects to remain strong within the City of Winnipeg is multi-family.

“Multi-family is the flavour of the decade, I think,” he said. “Especially rental accommodation, more than condos.”

PwC’s Emerging Trends in Real Estate 2020 report, for instance, notes baby boomers are downsizing and choosing to rent instead of purchasing condominiums.

Millennials are renting longer because they need to save more and for longer periods of time to raise a down payment for a home. Many millennials, in fact, are simply choosing not to become homeowners.

The report further notes renters are generally willing to pay more for quality living spaces close to amenities.

Residential rentals could well be the focus of a “flight to safety” during a volatile economic environment.

In a March webinar, Toronto-based Derek Lobo of SVN Rock Advisors stated that: “Other than the drugstores, the grocery stores and Netflix, almost every industry is envious of apartment owners. Everybody needs some place to live and I think things are going to be better for our industry than most.”

Existing Class-B apartment buildings, which represent the bulk of the market, should do well as people hunker down during this period of self-isolation, Lobo added.

In their report Coronavirus outbreak: implications for real estate released on March 23, Marcus & Millichap stated that…“(t)he apartment market will continue to deliver favorable performance… With vacancy rates near historic record-low levels across numerous markets, apartments will continue to deliver strong results.”

Millions of dollars of new development are either in the pipeline or under construction in Winnipeg at the beginning of 2020.

2019 was capped off with the completion of 223 & 225 Carlton Street at True North Square.

The expansion of the Class A market will continue. Wawanesa Insurance announced that it will run its North American operations out of a fifth True North Square building, which will be between 17 and 19 storeys high with more than 300,000 sq. ft. of space when it opens in 2023.

The Wawanesa building will be connected to the RBC Convention Centre, Bell MTS Place and the under-construction Sutton Hotel.

The company plans to amalgamate its 1,100 employees into one space. Currently, they are in six different locations, two of which they own. Wawanesa’s workforce has doubled in the last five years and the new building will provide room for further growth, Evan Johnston, Senior Vice-President at Wawanesa, said.

Shindico Realty plans to break ground early next year for a 124-suite apartment building at Grant Park Festival, a big-box centre in south Winnipeg.

If the company can attract a major office tenant, it will also build a 60,000 sq. ft. office building on the same property.

Shindico’s revised Kildonan Place project will feature less retail space than previously planned. The new proposal would add 500 new units, taking up about 100,000 sq. ft. with another 120,000 sq. ft. designated for commercial.

The estimated cost is about $130 M to $150 M, making it one of the largest mixed-use projects in the area, President Sandy Shindleman says. He hopes that construction will be complete in 2024.

Construction has begun on the Medical Arts Building to turn its 15 storeys of medical offices into 104 loft-style apartments with office and retail space on the lower two floors.

Timbercreek Asset Management, which bought the building for $15.5 M in April 2017 from Manitoba Liquor & Lotteries, plans to incorporate 39 one-bedroom units averaging in size of 677 sq. ft. each and 65 two-bedroom units averaging 892 sq. ft. plus 14,000 sq. ft. of commercial space. This is Timbercreek’s seventh Winnipeg property.

Construction continues on the Sutton Place Hotel and Residences. The 27-storey, 288-room Sutton Place Hotel and the accompanying 17-storey, 130-unit residential is scheduled for completion in 2022.

Academy Uptown Lanes bowling alley is being converted into a multi-use building, including retail, office and 23 condominiums.

Ron Penner, Senior Vice-President of operations at Globe Property Management, which owns the former bowling alley, said the plan is to have two commercial units on the main floor, some office space on the second and condos on all three.

The capital costs are expected to be in the neighbourhood of $8 M. Construction is projected to take 12 to 16 months and tenants could move in sometime in late 2020 or early 2021.

Lack of available product - not demand - moderated investment levels in 2019.

There was significant investment activity in the apartments sector as investors looked for stable income sources. Industrial properties are also in high demand, according to Re/Max Commercial.

Buyer types included REITs, pension funds, private equity players and private individuals. As cap rates moved lower in the primary Canadian markets, prior to the pandemic, Winnipeg was expected to see robust interest as it featured higher cap rates and stable market conditions.

468 units at three new rental properties in Regina and Winnipeg, which make up the Porchlight-Marwest multifamily portfolio, have been placed for sale by its owners. The portfolio includes:

• The newly constructed 241-unit Parliament located in southwest Regina.

• Monogram located in southeast Regina with 79 mostly two-bedroom units, averaging 713 sq. ft.

• The Winnipeg property, Lumen, a fully rented 148-townhouse development in the city’s southwest sector. The three-storey units average 1,053 sq. ft.

A multi-family rental portfolio of four newly constructed properties sold for $71.6 M to Skyline Apartment REIT. The acquisition consisted of 5 mid-rise apartments - Addison Square located at 10, 11 & 20 El Tassi Drive which made up of 3 buildings and 195 suites, and Waterford Village located at 10 Highwater Path & 90 Waterford Green Common having 2 buildings and 126 suites.

Recent industrial transactions include:

• 2015 Dugald Road sold for $6.4 M. The single-tenant, 46,046 sq. ft. industrial building is located in the city’s east end.

• 1781 Wellington Avenue sold for about $2.5 M. The multi-tenant 21,586 sq. ft. industrial building is located in the northwest of the city.

Keith Reading, Director of Research at Morguard writes that national and local investment groups continued to look at the GWA industrial sector as a source of attractive yields and stable income.

Office transactions in Q4 2019 include:

• 218 Kennedy Street sold for $2.0 M. The downtown single-tenant office building is 12,300 sq. ft. in size.

• 222 Osborne Street North sold for $2.6 M. The single-tenant office building is also located downtown and is 9,100 sq. ft. in size.

Colliers reported $44.9 M in sales of office buildings in the first half of 2019. This followed the $120.6 M in 2018, which was the highest level in four years. Income growth was the main performance-driver from June 2018 to June 2019 as valuations remained relatively flat, Reading reported.

How will the COVID-19 environment impact investment activity given the challenges that have been created to valuating assets?

Capital availability will likely constrict as a result of economic uncertainty.

The Coronavirus is causing some of Canada’s largest alternative lenders to freeze redemptions, according to BNN.

Vancouver-based Trez Capital, a provider of non-bank mortgages for commercial developments, froze redemptions on more than $3 B worth of investor funds.

Toronto-based Morrison Financial Mortgage Corp., which manages assets worth about $60 M, has suspended dividends, redemptions and new purchases.

Canada Life Assurance Co. temporarily halted all investor activity on its Canadian real estate funds.

Alternative players held 1% of Canadian mortgages last year, according to Canada Mortgage and Housing Corporation. There were 200 to 300 of the lenders active in Canada, holding $13 B - $14 B of outstanding Canadian mortgages. This was an increase from $8 B - $10 B in 2016.

COVID-19 will cause some capital markets transactions to be delayed or jeopardized due to practical constraints on completion (such as travel restrictions impacting on-site due diligence) or concerns over the outlook for the economy and occupier demand, Avison Young forecasts.

Transaction volumes are likely to fall the company states. While Q1 totals may be less affected, Q2 will be impacted by delays in completion and Q3 will be hit because few new transactions are currently being initiated. “Long income” deals that are less sensitive to the short-term outlook are in high demand and will be less affected than those higher-risk transactions requiring more active management and asset repositioning to drive IRRs.

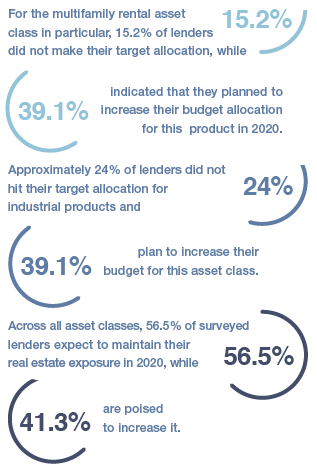

According to the results of CBRE’s annual lender survey which was completed prior to the pandemic, apartment and industrial properties are in the highest demand for lenders. The industrial sector has been bolstered by the tightest market fundamentals on record and the proliferation of e-commerce in Canada.

The premiums that lenders assign for Class B assets or secondary markets, while compressing slightly in 2019, remain elevated compared to years past. The modest contractions seen in these spreads are in line with their perspective that while we are late in the cycle, lenders felt more optimistic than they did this time last year.

Although it was low on the list among Canada’s major cities, 8.7% of survey respondents still stated that they had a strong desire to lend in Winnipeg.

CBRE writes that few respondents actually expressed no interest in lending in Winnipeg. Lender activity remained dependent on a deal or relationship-specific basis with 39.1% stating that lending in the Winnipeg market was deal-specific.

Among the provinces, 13% stated that they were underfunded in Manitoba in 2019 and 10.9% stated that they had plans to increase their budget in Manitoba in 2020.

According to JLL, the supply of debt capital was widely available in the Canadian market in 2019. However, both foreign and domestic lenders demonstrating more cautious behaviour. There has been a ‘flight to quality’ with a focus on sponsorship, stability of cash flow, asset quality, and preferential location.

Availability of land and lower costs have made Manitoba’s secondary cities attractive investment destinations.

Cheaper land and lower business operating costs have been fueling an increased demand for commercial real estate and new economic opportunities in smaller Manitoba communities outside of Winnipeg.

“People are going to all of these small places because it’s about affordability,” said Richard Crenian, President of ReDev Properties, of smaller Manitoba communities such as Portage la Prairie, Brandon and Steinbach.

Portage la Prairie

In the last couple of years, Portage la Prairie, 45 minutes away from Winnipeg, has attracted $1.2 B worth of investment. Portage la Prairie is home to the Province’s Food Development Centre, an agency that assists manufacturers and producers of all sizes to test and prepare their products for the market.

Simplot is in the process of a $460 M, 280,000 sq. ft. expansion of its 180,000 sq. ft. french fry processing plant that will increase the size of the facility and double the plant’s need for potatoes from regional growers. The plant is expected to be fully operational in 2020.

Simplot’s Portage la Prairie facility ships more than 300 million pounds of frozen french fries and specialty potato products each year to vendors across North America.

Roquette, a France-based company has invested $400 M into a pea protein processing facility – that is to be the largest of its kind in the world. The plant will create 150 ongoing positions upon the start of production which was slated for Spring 2019.

McCain Foods announced a $45 M reinvestment in its own potato processing plant and Green Sky Labs, a producer of medicinal cannabis, finalized plans for a $25 M plant in nearby Newton.

All of the development will result in more than 500 new jobs in town and the opening of new chain restaurants. More than 400 new apartments, townhouses and condominiums are currently under construction to meet the demand.

Construction has started on Prairie Lofts on First Street which will consist of four, two-storey buildings with 16 units each. Luke Wiebe of Prairie Lofts Condos said that 32 of the units will be at ground level with zero-step-entry, which he believes will appeal to seniors, singles and couples. Wiebe says they will also have two and three-bedroom condos.

Brandon

Private-sector investment has been on the increase in Brandonand the downtown area has taken on new life as a result of initiatives by the Brandon Downtown Development Corporation.

In an effort to encourage redevelopment of vacant or underutilized downtown properties, the development corporation’s Redevelopment Grant Program is providing a one-time grant of up to $175,000 for eligible pre-development professional fees and construction/material costs. As well, it will fund a maximum of 25% of eligible fees and project costs.

The Rent Abatement Program is another initiative that has been designed to subsidize a tenant’s rent in a downtown space by funding one month’s rent per year over the length of the lease agreement. The program has been fundamental in attracting new businesses into downtown, such as a boutique cycling studio, restaurants, a bakery and a bridal dress store, according to the Brandon Downtown Development Corporation.

The former Central Fire Station, which was built in 1911, has been converted into the Prairie Firehouse restaurant.

Fraser Block, a vacant 129-year-old building on Rosser Avenue, now has a coffee shop on the ground floor and a day spa on the second and third floor.

Skyline Developments’ planned Riverside Lifestyle Estates is a multi-phased project adjacent to Wheat City Golf Course. The development is to have a total of 67 residences beginning with a 43-unit building that would be constructed in the first phase. An additional 24-unit building is planned for phase two.

Steinbach

Located 45 minutes southeast of Winnipeg, Steinbach is running out of land. The city recently completed a land annexation of about 2,700 acres from the neighbouring rural municipality of Hanover because business demand has outgrown the existing space.

Steinbach North Business Park, a new commercial mixed-use development of retail and offices, on approximately 80 acres of land, broke ground at the end of 2018.

“The City of Steinbach taxable assessment on commercial and residential real estate has doubled in eight years from $526 M in 2010 to $939 M in 2018,” City Manager Troy Warkentin stated.

According to Statistics Canada, there has been a 17% increase in Steinbach’s population over the last five years. This is compared to the national average population growth of 5.0%. In the last 10 years, Steinbach has grown by 43%. The increase in population is largely due to the migration from the Philippines, other parts of Asia and from Europe.

“Agriculture has always had a direct effect on this region. However, with manufacturing, retail, pharmaceuticals, and financial services being added to the economic base, the area is expected to be stronger during various economic cycles,” Warkentin said.

Valeant Canada announced in March a new investment of $8 Minto its Steinbach, Manitoba manufacturing plant and will transfer the North American production of Xifaxan and Apriso this year, to its Steinbach facility.

The Steinbach facility is Valeant’s largest North American site operating 24 hours a day and employing 400 people.

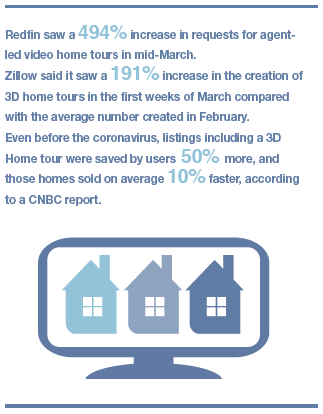

Social distancing is resulting in an uptick in the use of virtual reality and other web-based communication tools in the housing market.

Open houses, for now, are closed. The Manitoba, Winnipeg, and Brandon realty associations have suspended the public sales method.

Winnipeg area real estate agents are saying that communicationhas become largely web-based.

Virtual reality and virtual tours are providing ways for buyers to continue their property search from their homes. Some real estate agents and brokerages are using Google meetings, YouTube Live and Facebook Live to orchestrate virtual open houses.

And with so many people working from home, “we have to rethink how we communicate with our colleagues to ensure continued performance and, importantly, morale,” Sol Rogers writes in Forbes.

Virtual reality (VR) has become an alternative to video calls and one of the biggest benefits of the medium is its ability to make people feel like they are in the same space.

An additional benefit of VR is that all distractions are removed and people can be fully focused on what is happening around them, Rogers writes. MeetinVR claims that there is a 25% increase in attention span when meeting in virtual reality compared to video conferencing.

Spaces is a new PC VR app that was developed in light of the COVID-19 crisis to enable users to join video calls from within VR. Marketed as a “bridge between a VR world and Zoom, Skype, etc”, users are placed in a virtual environment with a virtual whiteboard and markers, alongside an adjustable virtual camera.

rumii is a social-virtual reality space that enables people to collaborate and communicate in one room as though they arein the same physical location—from anywhere in the world.

rumii has Google Poly (a website created by Google for users to browse, distribute, and download 3D objects) integration so users can prototype new products and work in 3D in real-time with your colleagues.

In light of all the benefits of VR, those that adopt it now as a necessity could well choose to maintain virtual communication as a long-term strategy.

Real Insights is powered by Altus Group’s Investment Transactions research. For more information, please visit altusgroup.com.