Bold ideas. Big deals.

Canada's largest commercial real estate meetup.

Join 2,700+ senior decision-makers, including 1350+ building owners, developers, & investors.

Had a great time at the 2023 forum?

Register now for the 2024 event and save with our early-bird price.

Some highlights from the 2023 event

"It is the place to network, connect and build relationship with all the key players in the industry. It's a must-attend." - Annie Houle, Head of Canada, Ivanhoé Cambridge

"It's the thought leadership, it's the thinking of everybody in this community coming together which is special. " - Peter Senst, President, Canadian Capital Markets, CBRE

"The program gives you the opportunity to explore where you want to dig deeper. A must go event for any real estate professional working in Canada. " - Wenzel Hoberg, Global Head of Real Estate, Fiera Real Estate

Canadian commercial real estate industry's marquee event of the year

It’s the largest. The most senior. With attendees from all over Canada and beyond. And marked in every CRE leader’s calendar.

Back in Toronto for the 32nd year

Join 2700+ senior leaders to examine the trends, risks, challenges, and opportunities present nationally and globally in all property classes.

Find out how the world of technology is impacting the real estate market and its organizations. What do real estate executives need to understand?

What is the path forward for the Canadian real estate market in 2024?

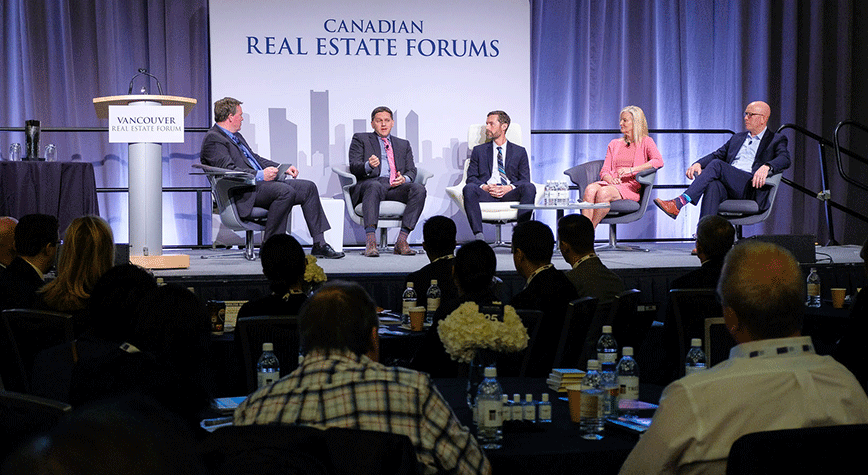

Informative panel discussions, keynote presentations, and case studies will maximize learning and power your decision-making.

Cutting-edge insights on the hottest topics

The agenda put together with the help of our advisory council focused on key topics including:

- The outlook for the U.S. and global markets and what it means for Canada.

- Canada in a shifting geopolitical context: Why rising geopolitical risks matter?

- C-suite perspectives – 2024 predictions, strategic thinking & thought-leadership

- Preparing for an influx of new residents: Is the multi-residential market ready? What opportunities exist?

Leadership perspectives from 90+ industry giants

Get valuable insights from 90+ renowned experts, including 40+ presidents, CEOs, and managing partners from the largest real estate organizations in Canada and the U.S.

Key speakers included:

- Benjamin Tal, Managing Director and Deputy Chief Economist, CIBC Capital Markets

- Amy Price, President, BentallGreenOak

- Colin Lynch, Managing Director & Head of Global Real Estate Investments, TD Asset Management

Connect with the biggest names in the CRE industry

The forum brings together 2700+ senior decision-makers from across Canada and beyond:

- 1350+ building owners, and developers

- Private and institutional investors

- Portfolio and investment managers

- Brokers, lenders, appraisers, lawyers

- and other senior real estate executives

Strengthen your network and build partnerships to accelerate your growth.

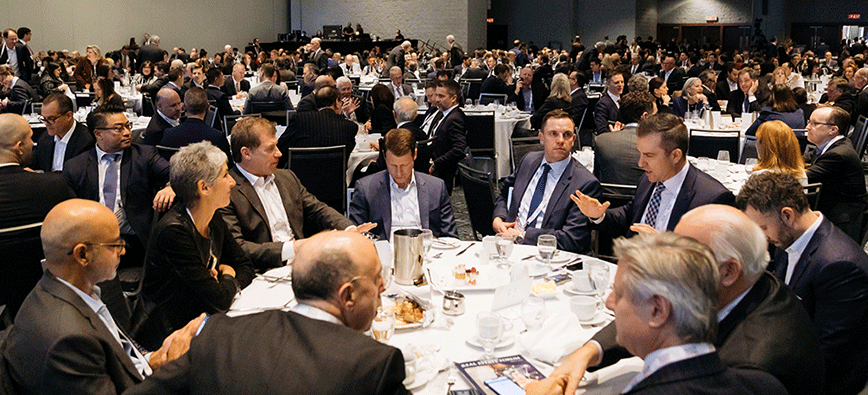

Experience unparalleled networking opportunities

We have structured the forum to help you meet with the people that can take your business to new heights.

Chairs' Reception, luncheons, dedicated refreshments breaks, networking reception, VIP lounge (invitation only), and evening social events provide multiple opportunities to connect and engage in meaningful conversations.

That's not all. Get a head start on your networking by reaching out to attendees before, during, and after the forum with the help of our smart event app.

Make the most of your time in Toronto

Save $75 by adding the Global Property Market conference to your booking. Held the day before on December 3 at the Metro Toronto Convention Centre.

By attending, you'll learn about investor strategies and gain expert knowledge on investment, capital flows, and development in tier one countries, growing economies, and emerging markets around the world.

Learn, network, and connect with global investors from institutions, fund managers, REITs, REOCs, and private investors.

Two action-packed days with 90+ speakers and 20 sessions.

A turbulent economic and geopolitical environment

Examine key trends, challenges, risks, and opportunities in the acquisition, investment, management, financing, development, and leasing of all property classes – office, industrial, retail and multi-unit residential.

The impact of record rates of inflation, rising interest rates, and higher cost of capital with a range of geopolitical trends will be a key focus.

What will the path forward likely be in 2024?

Understanding the Fourth Industrial Revolution

The unprecedented speed of technological change is fundamentally altering the way we live, work, socialize and relate to one another.

The breadth and depth of these changes will significantly affect the real estate industry and the way we conduct business.

Join the conversation with the most brilliant minds in the industry and understand how, why, and what opportunities are being created.

Vibrant cities, ESG, WFH and other key trends

To what extent are our cities, shopping, housing, and workplace environments changing? How have our downtowns fared since the pandemic?

What's needed to bring back the vitality that our city cores previously had?

Discover answers to these questions and dive deeper into topics like DE&I, innovative thinking, smart cities, and housing affordability. Plus ESG, impact investing, climate and cyber risk, and the future of workplace environments.

90+ expert speakers included:

Real Estate Forum by numbers

2700+

senior decision-makers

1350+

building owners, developers, and investors

1750+

V-level and C-level attendees

400+

attendees from financial institutions

90+

influential speakers

130+

attendees from outside Canada

A deep dive into the housing market

The Apartment Development & Affordable Housing Conference is an add-on event at the 2024 Toronto Real Estate Forum, held on Tuesday, December 3.

The line-up of sessions will span the entire apartment development timeline: financing, design, feasibility, operating costs, and operations.

Get the connections and strategic insights you need to succeed in the rental apartment market.

Forum delegates can add this event to their 2024 registration for just $999.

Want to sponsor?

The sponsorship program is designed to ensure that sponsors receive maximum corporate exposure to all attendees at the event. Each sponsorship level will offer a different package of value-added benefits. Tell us your business goals & we will help you achieve them.

Continuing education credits

By attending this forum, you will be eligible to receive professional development and education credits from a number of associations.

Get the latest event updates

Outstanding Young Leader Program

Do you have a colleague who is 35 years old or under and a rising star in the commercial real estate industry? Nominate them today for the Outstanding Young Leader 2023 award, presented by Informa Connect & Chicago Title Insurance Company Canada.

They could win registration to one of our major Forums, and have the chance to be named Outstanding Young Leader at the Real Estate Forum in November.

Canadian Real Estate Forums' digital community

Keep up with the latest in commercial real estate from our global network of experts all year round

The latest industry news

Canada’s leading website serving the commercial real estate market.

Discover the latest on leasing, investment, development, and financing of office, industrial, retail and multi-unit residential real estate across Canada.

Video insights

See exclusive videos of the key industry influencers.

Insights you only get through Canadian Real Estate Forums.

Publications and newsletters

Get in-depth analysis of market trends from industry leaders in our magazines, reports and conference white papers.

Plus subscribe to the bi-weekly newsletter to get the very latest news.

Join the REF Club

Be a part of the community that helps you stay informed and connected. REF Club membership benefits include:

- On-demand access to all recorded sessions from key Real Estate Forums events through the Streamly platform

- A 20% discount on forum and conference registrations. Bundle your registration and membership and start saving immediately!

- Priority for access to waitlisted forums and conferences

- An automatic $55 discount on continuing education credits when registering for our events